- Home

- Articles

- Architectural Portfolio

- Architectral Presentation

- Inspirational Stories

- Architecture News

- Visualization

- BIM Industry

- Facade Design

- Parametric Design

- Career

- Landscape Architecture

- Construction

- Artificial Intelligence

- Sketching

- Design Softwares

- Diagrams

- Writing

- Architectural Tips

- Sustainability

- Courses

- Concept

- Technology

- History & Heritage

- Future of Architecture

- Guides & How-To

- Art & Culture

- Projects

- Interior Design

- Competitions

- Jobs

- Store

- Tools

- More

- Home

- Articles

- Architectural Portfolio

- Architectral Presentation

- Inspirational Stories

- Architecture News

- Visualization

- BIM Industry

- Facade Design

- Parametric Design

- Career

- Landscape Architecture

- Construction

- Artificial Intelligence

- Sketching

- Design Softwares

- Diagrams

- Writing

- Architectural Tips

- Sustainability

- Courses

- Concept

- Technology

- History & Heritage

- Future of Architecture

- Guides & How-To

- Art & Culture

- Projects

- Interior Design

- Competitions

- Jobs

- Store

- Tools

- More

The Price of Beauty: Evaluating Architecture’s Financial Impact

Table of Contents Show

In the heart of every city lies an assemblage of structures, each a testament to human ingenuity and artistic expression. Yet, beneath the surface of these architectural marvels is a web of financial implications often overlooked by the casual observer. Architecture is not merely an art form; it serves as a financial pillar for communities, shaping economies through its creation and existence. The balance sheet of beauty is complex, intertwining aesthetic value with cold, hard cash.

Economic Foundations Shaped by Form

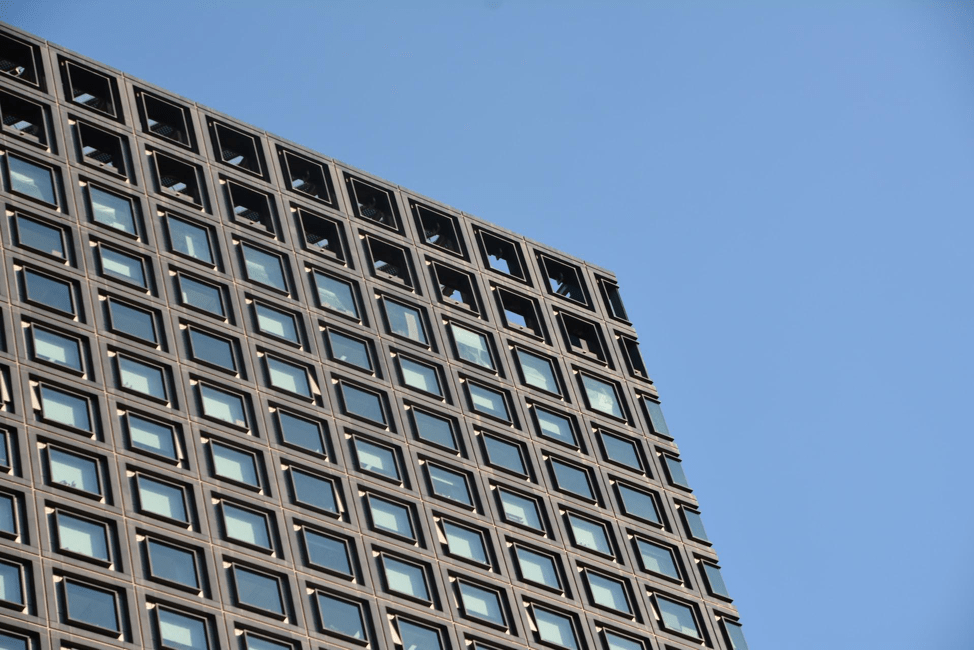

The very skyline of a city can be its selling point, attracting tourists and businesses alike. Iconic structures such as the Sydney Opera House or the Burj Khalifa are not just design masterpieces but economic powerhouses generating millions in tourism revenue. Every arch and spire is a potential profit center, but the cost of creating such landmarks is immense. The initial investment into these grand designs can run into billions, and the return on that investment can take decades to realize.

The Cost of Keeping Up Appearances

Maintenance and restoration of existing structures present another financial challenge. While rich in cultural value, historical buildings demand a continuous flow of funds to preserve their legacy against the ravages of time. The price of authenticity is high, and the responsibility often falls upon the government’s shoulders. This raises the question – how do we balance the preservation of architectural heritage with the need for financial prudence?

High Stakes in Urban Development

Urban planning and architecture are inextricably linked, with the latter playing a pivotal role in the former. Developing a new district or revitalizing an old one can hinge upon the architectural vision set forth. Here, the stakes are high, as the wrong decision can lead to urban blight and financial ruin, while the right one can result in booming property values and vibrant communities.

Residential Realities: Design vs. Affordability

On a smaller scale, residential architecture also wields financial influence. The desire for aesthetically pleasing homes must be weighed against the reality of housing affordability. Innovative design can drive up costs, pricing out potential homeowners. Yet, a well-designed neighborhood can increase property values over time, benefiting homeowners and the city through increased tax revenues.

The Role of Financing in Architectural Ambition

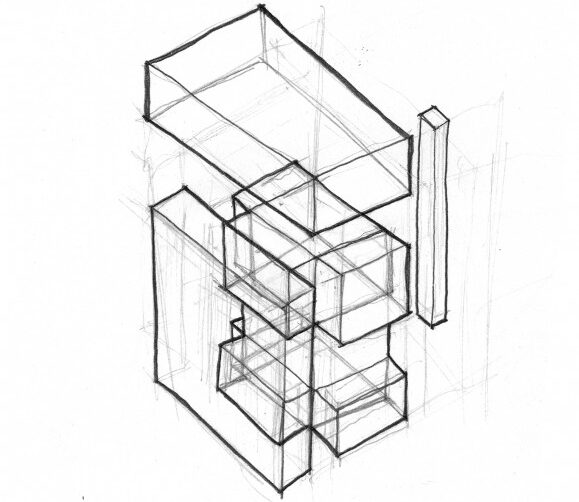

Financing plays a critical role in turning architectural dreams into reality. The terms of a simple loan can determine the viability of a project. Interest rates, collateral requirements, and repayment schedules all factor into the equation, dictating which projects move forward and remain on the drawing board. Financial institutions thus have a hand in shaping our built environment, for better or worse.

Sustainability: A Long-Term Investment

Sustainability in architecture requires an upfront financial commitment that promises long-term savings. Green buildings may cost more to construct, but the reduction in energy consumption and environmental impact can lead to significant financial gains over the structure’s lifespan. However, the initial barrier to entry remains a deterrent for some despite the potential for future cost reductions.

Conclusion: The Architectural Balance Sheet

As we survey the towering skyscrapers and sprawling suburbs that compose our cities, it’s clear that architecture holds more than aesthetic value—it is a dynamic participant in the economy. From the fervor of construction to the silent decay of neglect, each phase of a building’s life incurs a cost and offers potential gain. The financial impact of architecture is vast and multifaceted, echoing through the halls of banks and the streets of neighborhoods. Ultimately, the price of beauty is one we collectively decide to pay, investing in the belief that our structures will stand as enduring legacies of our societal priorities and economic foresight.

illustrarch is your daily dose of architecture. Leading community designed for all lovers of illustration and #drawing.

Submit your architectural projects

Follow these steps for submission your project. Submission FormLatest Posts

Shigeru Ban Architecture: Vision, Awards & Humanitarian Design

Discover how Shigeru Ban revolutionized architecture with paper tubes, disaster relief shelters,...

Revolutionizing Video Commerce: How E-Commerce Brands Are Scaling Product Videos with AI

Table of Contents Show The Product Video Problem: Why Scale MattersThe Seedance...

The Complete Beginner DIY Plumbing Checklist: A Step-by-Step Guide for First-Time Home Projects

Table of Contents Show Step 1: Confirm the Job Is Truly Beginner-FriendlyStep...

Top Job Alternatives for Architects and Interior Designers

Explore diverse job alternatives for architects and interior designers, from creative roles...

Leave a comment