- Home

- Articles

- Architectural Portfolio

- Architectral Presentation

- Inspirational Stories

- Architecture News

- Visualization

- BIM Industry

- Facade Design

- Parametric Design

- Career

- Landscape Architecture

- Construction

- Artificial Intelligence

- Sketching

- Design Softwares

- Diagrams

- Writing

- Architectural Tips

- Sustainability

- Courses

- Concept

- Technology

- History & Heritage

- Future of Architecture

- Guides & How-To

- Projects

- Interior Design

- Competitions

- Jobs

- Store

- Tools

- More

- Home

- Articles

- Architectural Portfolio

- Architectral Presentation

- Inspirational Stories

- Architecture News

- Visualization

- BIM Industry

- Facade Design

- Parametric Design

- Career

- Landscape Architecture

- Construction

- Artificial Intelligence

- Sketching

- Design Softwares

- Diagrams

- Writing

- Architectural Tips

- Sustainability

- Courses

- Concept

- Technology

- History & Heritage

- Future of Architecture

- Guides & How-To

- Projects

- Interior Design

- Competitions

- Jobs

- Store

- Tools

- More

Common Mistakes in Duty Drawback Claims and How to Avoid Them

Did you know your business could reclaim up to 99% of import duties paid with the right duty drawback solutions?

Companies pay over USD 100 billion in import duties each year, and customs refunds only USD 2-3 billion. The most surprising part? Around USD 50 billion stays eligible but unclaimed.

Preventable mistakes in the duty drawback process create this massive gap. This program started way back in 1789, offering businesses a way to get refunds and build up their operating cash. When claims have mistakes, you’ll often face slower processing, denials, and sometimes even extra charges.

Companies have a five-year window to file claims, yet many miss their chance to recover substantial funds.

Let me walk you through the most common duty drawback mistakes and practical ways to avoid them.

We’ll look at everything from documentation gaps to incorrect data matching – errors that cost businesses millions in potential refunds.

We’ll give you the lowdown on making it work. Do you want to recover money paid on import duties?

A smart computer program can help you get those refunds faster. Let duty drawback pros make your claims truly pay off.

Table of Contents

ToggleWhere Most Duty Drawback Claims Go Wrong

Duty drawback claims are more complex than they appear. Many companies lose money from simple slip-ups they could easily fix. Often, these ideas stumble because of multiple weak points.

Documentation Gaps And Missing Forms

Your claim’s success depends on proper paperwork. CBP rejects claims most often because of incomplete or missing documentation. Businesses must clearly show how imported goods connect with their exports.

Your required documents should include:

- Import entries and duty payment records

- Export bills of lading and proof of exportation

- Commercial invoices from both transactions

- Inventory or production records

A single missing document could stop your refund completely. CBP also requires you to keep these records for at least three years after your claim liquidation.

Incorrect Matching Of Import And Export Data

Having documents isn’t enough – they must tell the same story. Product descriptions between import and export papers often don’t match. These differences make it hard to show CBP the connections they need.

There’s another reason why matching becomes difficult. Companies typically store their import data in one system and export data in another. Without linking these systems properly, proving eligibility becomes much harder.

Failure To Meet The 5-Year Claim Window

Time moves quickly in the import business. The United States law gives you five years from your import date to file a drawback claim. After this deadline passes, you can’t get extensions – and with good reason, too.

Companies often find out they qualify for drawback after several years pass. Much of their eligible imports might expire by then.

Misunderstanding Substitution Vs Direct Identification

Choosing the wrong drawback type can get pricey. Direct identification needs specific import-to-export tracking, while substitution works with commercially interchangeable goods.

People usually pick direct identification (1313(j)(1)) because it seems easier. Many companies actually qualify for the substitution drawback, which works better with combined inventory. Without knowing the difference, you might miss out on significant refunds.

This era’s latest. Get your money back on import taxes when you re-export items. Imagine getting solid support to conquer those tricky issues! You’ll pinpoint costly errors before they ever drain your wallet.

The Cost of Mistakes in Duty Drawback

Mistakes in duty drawback claims can hurt your bottom line more than you think. Just one slip-up, CBP says, can blow up into huge financial headaches.

Delayed Or Denied Refunds

CBP will quickly reject your claim if they spot errors. Your claims will get denied if you submit incomplete documentation or incorrect data. Small discrepancies can trigger a desk review that adds weeks or months to your refund timeline.

CBP might even liquidate claims without any drawback benefit, which means you lose your entire refund.

Increased Audit Risk

Your problematic claims can put you under CBP’s microscope. CBP runs three types of audits that get more invasive:

- Desk audits: Written requests to clarify or add documentation

- Compliance reviews: On-site checks and document verification

- Regulatory audits: Big record requests and multiple face-to-face meetings

Every error pattern makes you more likely to face customs scrutiny. Failed audits can damage your refund chances and your CBP reputation.

Loss of potential cash flow

The numbers are shocking: companies leave about USD 2.4 billion in eligible drawback funds unclaimed each year. Companies with high import volumes miss out on much working capital. On top of that, it gets pricey when interest builds up on delayed refunds. Companies with tight margins can’t afford to have this critical cash flow stuck with the government.

Compliance Penalties From CBP

CBP does more than deny claims; they can hit you with serious penalties. Fraudulent violations might cost you up to 3 times the actual or potential revenue loss.

Even careless mistakes come with penalties:

- First violation: Up to 20% of the revenue loss

- Second violation: Up to 50% of revenue loss

- Subsequent violations: Up to 100% of revenue loss

Need some protection? Current styles. Getting back customs money on exports. Automatic systems check your data and find errors. This prevents those expensive budget mistakes from happening.

Fixing the Process: How to Improve Your Claims

Your duty drawback process needs fixing after spotting errors that get pricey. A few targeted improvements can turn those rejected claims into successful refunds.

Automate Data Collection And Proving It Right

Most mistakes happen because of manual data entry. Smart companies now let automation eliminate these errors. Modern duty drawback software pulls data straight from ERPs, broker feeds, and even PDFs.

These systems match import entries with export invoices automatically and check quantities, values, and dates with precision.

Tech solutions check HTS codes to line up and spot potential mismatches before submission. Let technology do the heavy lifting instead of copying line items from scanned invoices.

Use Duty Drawback Services To Get Expert Help

Working with specialists makes financial sense because CBP regulations are complex. Duty drawback brokers bring specialized skills and know the latest policy changes. Their strong ties with CBP authorities lead to higher approval rates during reviews.

Look at the cost-benefit analysis first – weigh contract fees against potential in-house costs like salaries, training, and systems. Trying to handle every skill internally can hold companies back. Often, bringing in outside help brings far better results.

Put Internal Compliance Checks In Place

Self-audits are your best shield against CBP scrutiny. Review your drawback procedures regularly and keep up with changing trade policies. Accuracy can make or break you – mistakes can trigger penalties or permanent refund loss.

Set Up A Timeline To File Claims Periodically

Filing claims at quarter-end isn’t ideal. Set up automated triggers that start the claim process right when goods cross U.S. borders. Your refunds come faster, and you avoid last-minute rushes.

Note that retroactive claims work too – you can get back duties on exports shipped within the past three years.

Track Claim Status With Dashboards

Good tracking prevents compliance penalties and helps manage cash flow better. Modern duty drawback solutions show live dashboards with claim progress and expected refunds. These charts and graphs point you straight to the claims about to run out of time.

Watch things closely and you’ll catch missing documents early, preventing permanent refund loss from rejected claims.

Stop Those Errors Before They Even Begin.

You can use today’s tech to make your duty drawback claims run much faster. Imagine having more hours in your day, extra cash in your pocket, and less worry on your mind. These clever tools make that happen.

Duty Drawback Software With AI Features

AI-powered platforms match imports with exports automatically by running simulations on your data. These systems review thousands of combinations quickly and find the most valuable refund paths.

Some platforms increase refunds by 15% when compared to traditional methods.

You’ll see this with businesses that really stand out, such as Pax. Our smart analysis gets the most back, avoiding human delays.

OCR Tools For Document Digitization

Optical Character Recognition technology turns physical documents into searchable digital files. The software grabs information right off scanned customs papers and organizes it into easy-to-read reports.

When data entry isn’t done by hand, transcription errors drop significantly, and the whole document validation process moves much faster. Plenty of programs connect with your company’s main systems, so data moves freely.

Ace Portal For Historical Data Access

The Automated Commercial Environment portal gives you crucial historical trade data. All drawback claims must go through the electronic filing process. Users can pull standard reports on account transactions and create custom reports that show drawback opportunities. This online spot brings together all the ways CBP shares information.

Customs Broker Platforms For Claim Filing

Broker-specific software makes claim preparation and submission simple. These platforms link to ACE through Automated Broker Interface (ABI) certification. Built-in alerts notify you about potential drawback opportunities. Some platforms even let you access accelerated payment options.

Analytics Tools For Refund Optimization

Advanced analytics monitor each step from customs declaration to refund receipt. Live dashboards show your claim progress, expected refunds, and audit trails. You’ll stay ahead of claims that are nearing their end. You’ll also grab opportunities you might have otherwise passed by. You’ll also clearly see the cash coming your way from claims that haven’t been settled yet.

Conclusion

Duty drawback offers a substantial financial opportunity that many companies overlook. You’ll see here how little slip-ups can turn into big problems fast. Missing documents, incorrect data matching, and blown deadlines cost American businesses billions each year.

Your company might be sitting on thousands or even millions of dollars in potential refunds. These funds rightfully belong to your business. The government isn’t doing you a favor – they’re returning your money.

You now have real options to move ahead. Automation emerges as the most effective fix for most drawback challenges. Smart software catches mistakes before they happen and speeds up the entire process. Expert guidance pays for itself through higher approval rates and faster processing.

You don’t need to tackle drawback claims alone. Getting your customs duties back is smart. Think of us as your helper, smoothing out all the bumps in this procedure. Forget the old paperwork headaches. These systems now make your money flow in a clear, consistent way.

Five years might seem like plenty of time to file claims, but that window closes faster than you think. Start by scrutinizing your import/export activity from the last few years. The money awaiting recovery might surprise you.

Duty drawback isn’t just a nice-to-have program; it’s cash your business has already paid out. Your money shouldn’t sit in government coffers when it could work for you instead. Take action today, fix your drawback process, and watch those refunds roll in.

illustrarch is your daily dose of architecture. Leading community designed for all lovers of illustration and #drawing.

Submit your architectural projects

Follow these steps for submission your project. Submission FormLatest Posts

Understanding the Role of a Retirement Custodian in Your Investment Plan

Retirement involves numerous moving parts, which require proper planning. Choosing a retirement...

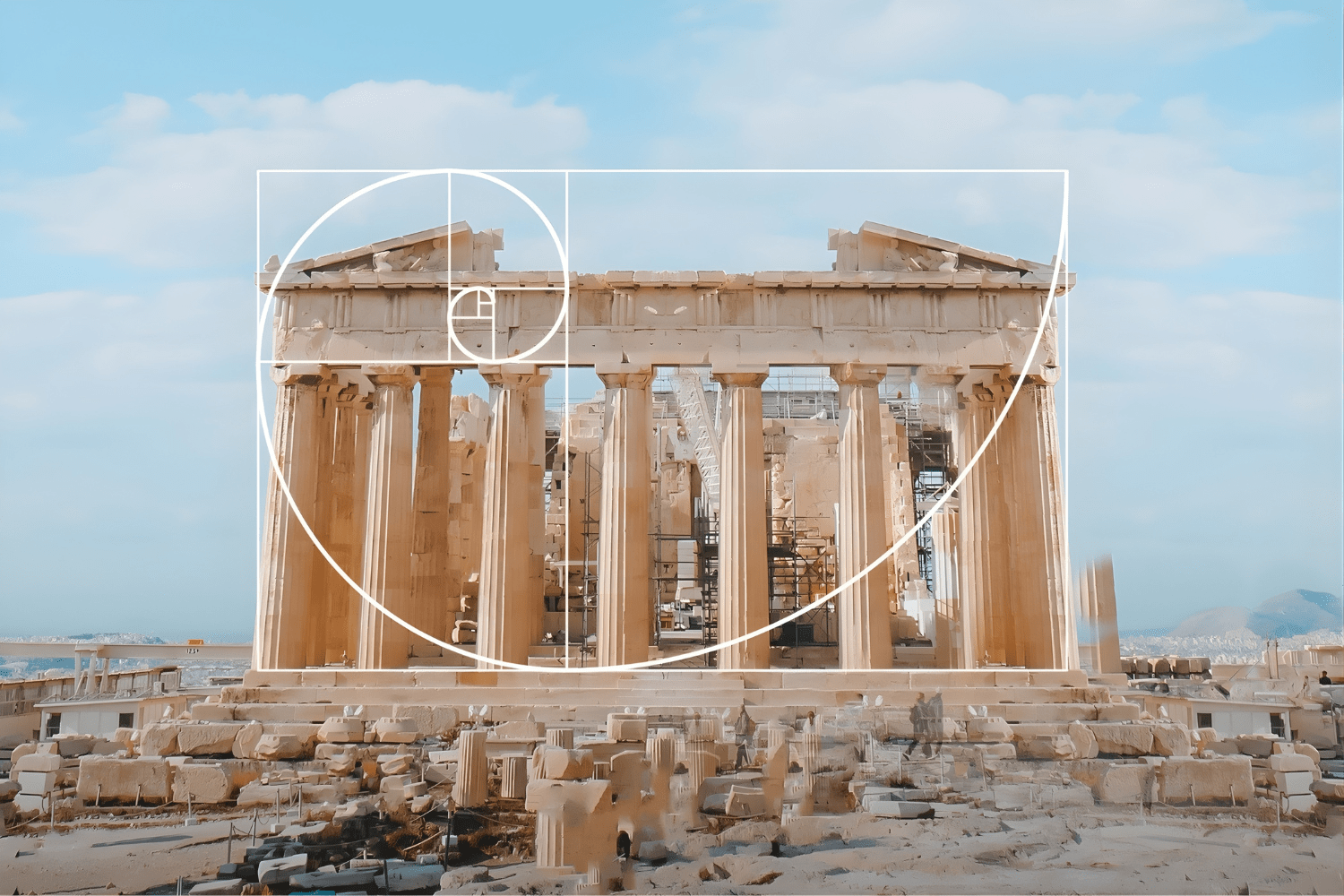

How Architects Use the Golden Ratio in Design

The Golden Ratio, approximately 1:1.618, has guided architects, designers, and artists for...

Practical Solutions To Balance Staff Roles And Automated Assistance

Businesses today operate in environments where efficiency, responsiveness, and adaptability matter more...

How Designers Can Use Custom QR Codes to Enhance Branding and User Experience

Design has always been about meaning. A shape, a colour, a line...

Leave a comment