- Home

- Articles

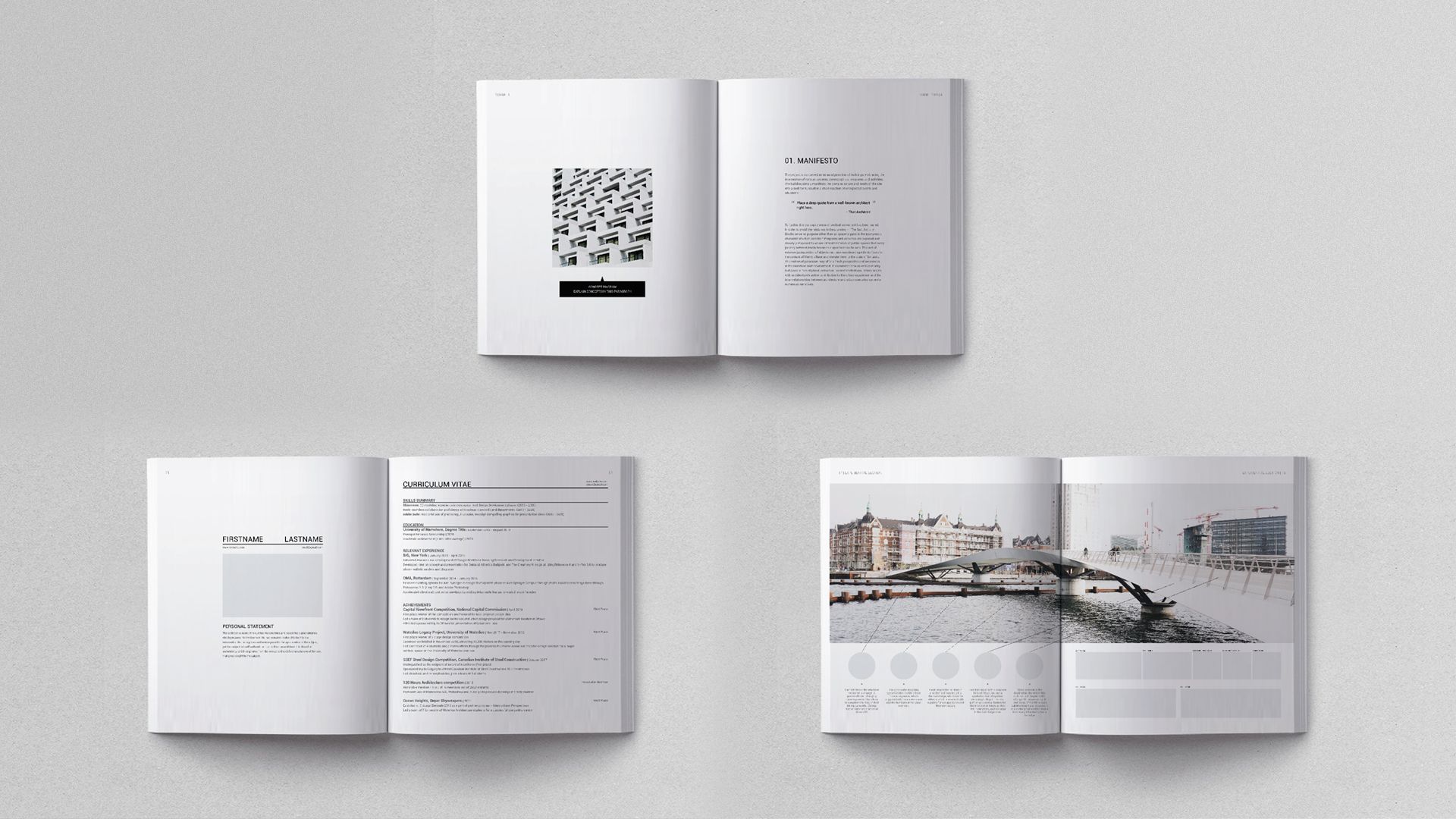

- Architectural Portfolio

- Architectral Presentation

- Inspirational Stories

- Architecture News

- Visualization

- BIM Industry

- Facade Design

- Parametric Design

- Career

- Landscape Architecture

- Construction

- Artificial Intelligence

- Sketching

- Design Softwares

- Diagrams

- Writing

- Architectural Tips

- Sustainability

- Courses

- Concept

- Technology

- History & Heritage

- Future of Architecture

- Guides & How-To

- Art & Culture

- Projects

- Interior Design

- Competitions

- Jobs

- Store

- Tools

- More

- Home

- Articles

- Architectural Portfolio

- Architectral Presentation

- Inspirational Stories

- Architecture News

- Visualization

- BIM Industry

- Facade Design

- Parametric Design

- Career

- Landscape Architecture

- Construction

- Artificial Intelligence

- Sketching

- Design Softwares

- Diagrams

- Writing

- Architectural Tips

- Sustainability

- Courses

- Concept

- Technology

- History & Heritage

- Future of Architecture

- Guides & How-To

- Art & Culture

- Projects

- Interior Design

- Competitions

- Jobs

- Store

- Tools

- More

UK Carpet Market Shows 7.4 Percentage Point Split Between Premium Growth and Retail Decline

Table of Contents Show

Analysis from Designer Carpet reveals wool flooring commanding half the market as traditional retailers struggle

The collapse of Carpetright in July 2024, with 218 store closures and over 1,500 job losses, painted a grim picture for UK flooring retail. Yet the product market tells a different story. Analysis by UK-based luxury carpet store Designer Carpet reveals a significant split forming in the carpet sector: traditional retailers are contracting at around 3.2% annually, but the premium natural fibre segment is expanding at over 4% year-on-year. That 7.4 percentage point differential represents a fundamental shift in how consumers are buying carpet, with implications for architects and interior specifiers.

The Premium Pivot: Calculating the Gap

Designer Carpet’s analysis of sales patterns and industry data points to wool carpet now accounting for approximately half of all UK carpet sales by value. For a market approaching £1 billion annually, that represents a substantial concentration of spending in a single material category.

The contrast with retail performance is stark. Traditional carpet retailers have seen five consecutive years of declining revenues, with the Carpetright administration exposing over £200 million in debts. Yet during this same period, enquiries for premium natural fibres at specialist suppliers have grown consistently.

What explains a declining retail channel within a growing product market?

The Disappearing Middle

The answer lies in a market that is hollowing out. Consumers are either abandoning carpet entirely for hard flooring, or they are investing more per square metre in premium natural fibres. The middle ground, where high street retailers traditionally operated, is shrinking.

Consider the maths. If total carpet retail revenue is falling while premium segment value grows, the decline in mid-market sales must be steeper than the headline figures suggest. Designer Carpet’s estimates put this mid-market contraction at closer to 8-10% annually, masked by resilient performance at the premium end.

Several factors drive this bifurcation:

- Post-pandemic specification shifts. Residential flooring now accounts for roughly two-thirds of UK floor covering purchases. Homeowners who invested in their properties during lockdowns have continued to prioritise comfort and quality over cost, creating sustained demand for natural fibres.

- Generational purchasing patterns. Younger buyers demonstrate stronger preferences for materials with environmental credentials. Wool, sisal and jute appeal directly to this cohort, who are willing to pay more for biodegradable, low-emission flooring.

- Channel migration. Spending that once went through high street showrooms has shifted to specialist suppliers, online specification and direct-from-manufacturer purchases. The traditional retail model is losing share faster than the product category it served.

“Natural products like wool, sisal and seagrass have moved from niche choices to mainstream specifications,” says Ben Herbert, Director at Designer Carpet. “Clients are asking for them by name. The cost barrier that previously limited natural fibre to luxury projects is disappearing as alternative sourcing models make premium brands accessible at different price points.”

A Two-Speed Market

Designer Carpet’s analysis identifies what might be termed a “two-speed market” in UK flooring:

- Speed one: contraction. Traditional retail, mid-market synthetic carpet, volume-driven business models. This segment faces ongoing pressure from hard flooring alternatives and changing consumer priorities.

- Speed two: growth. Premium natural fibres, specialist suppliers, specification-led purchasing. This segment benefits from sustainability trends, biophilic design interest and post-pandemic home investment.

The practical implication for architects is that mid-market carpet specifications will become harder to source reliably as traditional channels contract. Meanwhile, premium natural fibres are becoming more accessible and more frequently client-requested.

Reading the Market Direction

The 7.4 percentage point gap between retail decline and premium growth is not a temporary fluctuation. It reflects structural changes in consumer behaviour that show no sign of reversing.

Government housing targets and planning reforms are expected to support new residential construction over the coming years, creating fresh specification opportunities. The residential sector’s parallel shift toward renovation over relocation, driven by limited new housing supply, extends the pipeline for premium flooring in existing properties.

For architects working on residential projects, this analysis points toward a clear conclusion: natural fibre specifications carry less commercial risk than they once did. The market has moved. Wool carpet’s position as approximately half of all sales by value confirms that clients are ready to invest in premium flooring when presented with the option.

The traditional retail model built around mid-market carpet is struggling. But the product category it served is finding new life through different channels, at different price points, for clients with different priorities.

Architect specializing in digital products and content creation. Currently managing learnarchitecture.online and illustrarch.com, offering valuable resources and blogs for the architectural community.

Submit your architectural projects

Follow these steps for submission your project. Submission FormLatest Posts

Top 10 Most Inspiring Women in Architecture

Explore the remarkable achievements of women in architecture who transformed the profession...

Acropolis of Athens: Architecture as a Political and Cultural Statement

From the Parthenon to the Erechtheion, the Acropolis of Athens stands as...

How to Understand Rental Appraisals: A Full Guide

Rental appraisals are essential for setting competitive rent prices and maximizing investment...

10 Things You Need To Do To Create a Successful Architectural Portfolio

Discover 10 essential steps to create a successful architecture portfolio. From cover...

Leave a comment